|

|

UAE Freezones Biz News Updates

|

|

|

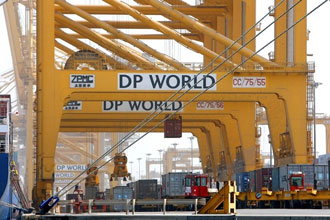

Global port operator DP World beats forecasts with profits 42% higher

Jebel Ali,

DP World's headquarters, was again the mainstay of the business.

Booming global trade, especially in Asia, helped DP World, the UAE’s

global ports operator, to report a 42 per cent increase in profits at the

halfway stage, ahead of most experts’ expectations.

With some signs of recovery in European business, DPW made US$372 million in

the six months to June 30, compared to $295m in the first half of last year.

The mid-way result reflected a big improvement in margins, on the back of an

11 per cent revenue increase to $13 billion.

Jebel Ali, the group’s headquarters, was again the mainstay of the business.

Mohammed Sharaf, the chief executive, said that the economy in the UAE and

the wider region was “robust”, and that growth was driven by tourism and

logistics, with the benefits of the Expo 2020 business exhibition still to

come.

However, he warned that “continued geopolitical issues may result in

challenges as the year progresses”.

Mr Sharaf added: “Historically our second half throughput performance has

been stronger than the first and we expect that trend to continue. The solid

financial performance of the first six months is reassuring and we are

confident of meeting full-year market expectations.”

The company, which is 80 per cent owned by the Government of Dubai via the

Dubai World conglomerate, reports its financial results on a like-for-like

basis, adjusting for changes in the core business and foreign exchange

volatility. Before these adjustments, the rate of growth in the first half

was 26 per cent, on a revenue increase of 8.5 per cent.

The company is financially strong. It raised $1bn in the period through a

convertible bond, and increased its revolving credit facility to $3bn.

“These actions have left us with the flexibility to support growth in our

existing business, and expand capacity in line with market demand. Moreover,

we have the financial resources to add to our portfolio should favourable

assets at attractive prices become available,” Mr Sharaf said.

He added: “The substantial investment programme that we initiated in 2012 is

starting to bear fruit as new capacity aids in the delivery of stronger top

and bottom line growth. We have made good progress at our recently opened

greenfield projects in Embraport, Brazil and London Gateway, and we look

forward to adding a further 8 million TEU [container capacity units] to our

portfolio over the next two years, providing further opportunity for growth.

“Crucially, our balance sheet remains strong and we continue to generate

high levels of cashflow, which gives us the ability to invest in the future

growth of our current portfolio, and the flexibility to make new investments

should the right opportunities arise as well as delivering enhanced returns

to shareholders over the medium term,” he added.

Sultan bin Sulayem, the DPW chairman, said: “The addition of new capacity

and a pick-up in global trade has resulted in a return to robust volume

growth, which has translated into an impressive financial performance.”

However, DP World shares – traded on the Nasdaq Dubai and London Stock

Exchange markets – fell by about 4 per cent in the course of the day on big

trading volumes. One analyst said: “The half-year figures are fine, and are

not the driver of the volumes or price movement. I believe there has been a

programmed account seller in the market in the course of the day.”

The share volatility also coincided with a reweighting of the UAE market

index by MSCI, the compilers. DP World is one of the largest constituents of

the index.

Aug 28, 2014 |

| |

Courtesy The National

|

|